Over the coming year, global capital markets may face a trio of torpedoes in the water: slowing growth, rising interest rates, and net aggregate withdrawal of liquidity by the world’s major central banks. Value-oriented managers are looking forward to bargains as capital is reallocated through the cycle. Unlike prior cycles, however, we believe that success through the next demands attention to a third analytical dimension alongside fundamentals and valuation: that of corporate sustainability.

As financial conditions tighten, weak links are beginning to break, revealing corporate sustainability to be a key pillar of business durability. The evidence is hiding in plain sight. One must look no further than corporate giant General Electric as an example of the deleterious effects of poor governance, leverage, and an outdated carbon-heavy capital allocation strategy. We expect that companies that did not take advantage of sustained economic growth and low interest rates to sufficiently realign their business to prioritize sustainability will be at a distinct disadvantage when the capital markets redistribute capital.

Given the existential risks associated with climate change and the profound social tensions that have arisen in large part from socio-economic, gender, and racial inequalities, we believe that financial, environmental, and social conditions are tightening simultaneously. Stakeholder expectations for environmental and social responsibility will likely continue to rise independent of the business cycle, and companies that have not taken seriously the imperative to adapt may risk losing their social license to operate. We expect the feedback loop between financial markets and the pace of social and environmental adaptation to strengthen, and that laggard businesses will suffer.

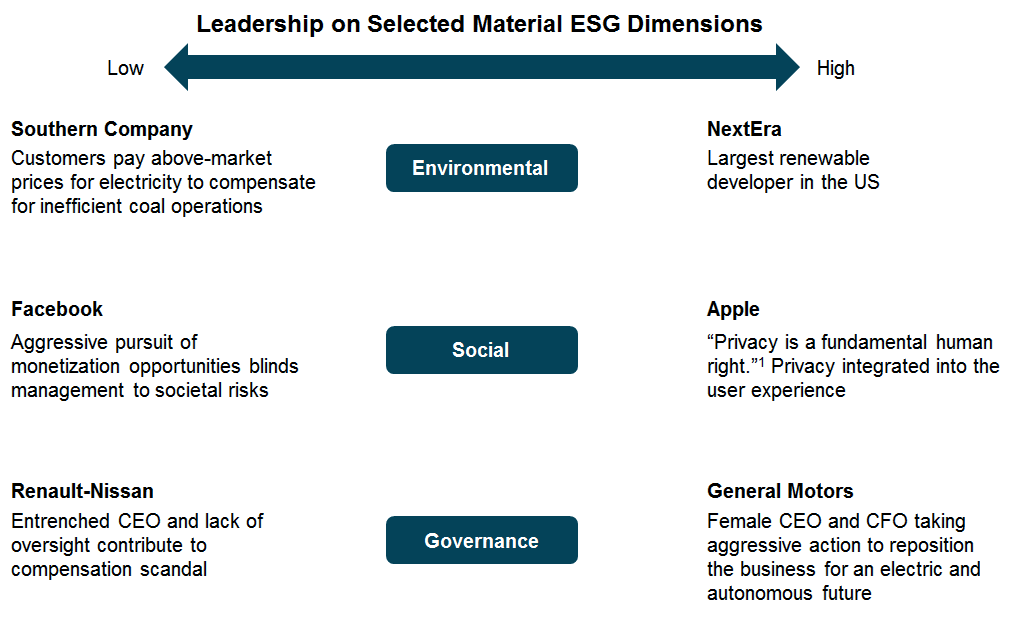

In the table below, each of the companies on the right side has embraced sustainability as a core value and has embedded it within its corporate strategy and operational DNA. We believe that companies like these—that lead on material environmental and social dimensions—should have an advantage in attracting capital, all else equal. We do not argue that sustainability leadership is a sufficient condition for long-term success, but rather that it is a necessary one.

We recommend that all investors underwrite ESG considerations in parallel with their traditional underwriting process and develop procedures to ensure appropriate weighting of these crucial criteria. Investors with an investment horizon spanning a full economic cycle should place extra emphasis on ESG considerations as certain of these issues present transformative opportunities and existential risks to certain industries.

Looking back on 2018, in which none of the major asset classes outperformed the consumer price index, it’s notable that European carbon allowances have increased in price by over 200%2 and California’s Low Carbon Fuel Standard (LCFS) credits have increased in price by 88%.3 Industrial re-alignment has begun and may be accelerated by business failures brought about by changing capital markets conditions. Even more than in prior cycles, we expect to see who has been swimming naked when the tide goes out.

- Source: apple.com/privacy.

- Source: Intercontinental Exchange (ICE). December 2019 EUA future finished 2018 at €25.03 vs €8.25 at the end of 2017.

- Source: California Air Resources Board. Average monthly credit price in November 2018 vs 2017.